In the fast-paced world of trading, where the stakes can be impossibly high and the margins razor-thin, trading simulators have emerged as vital tools for both novice and seasoned traders alike. These digital platforms offer the tantalizing prospect of risk-free practice, allowing users to hone their skills, test strategies, and simulate market dynamics.

Yet, amidst the potential benefits lies a lurking danger: the risk of developing a false sense of security. Engaging in simulated trading can create a deceptive picture of competence, leading to overconfidence when it comes time to navigate the real markets.

As traders immerse themselves in these virtual environments, understanding how to maintain a realistic perspective becomes paramount. This article delves into the intricacies of trading simulators, exploring effective ways to ground yourself in reality and safeguard against the pitfalls of misplaced confidence.

Prepare to uncover strategies that will help you differentiate between simulation success and the harsh lessons of actual trading.

The Benefits of Using Trading Simulators

Trading simulators offer a unique gateway into the world of trading, allowing individuals to practice without the high stakes of real money. By simulating real market conditions, these tools provide a risk-free environment where traders can refine their strategies, test new ideas, and gain invaluable insights into market behavior.

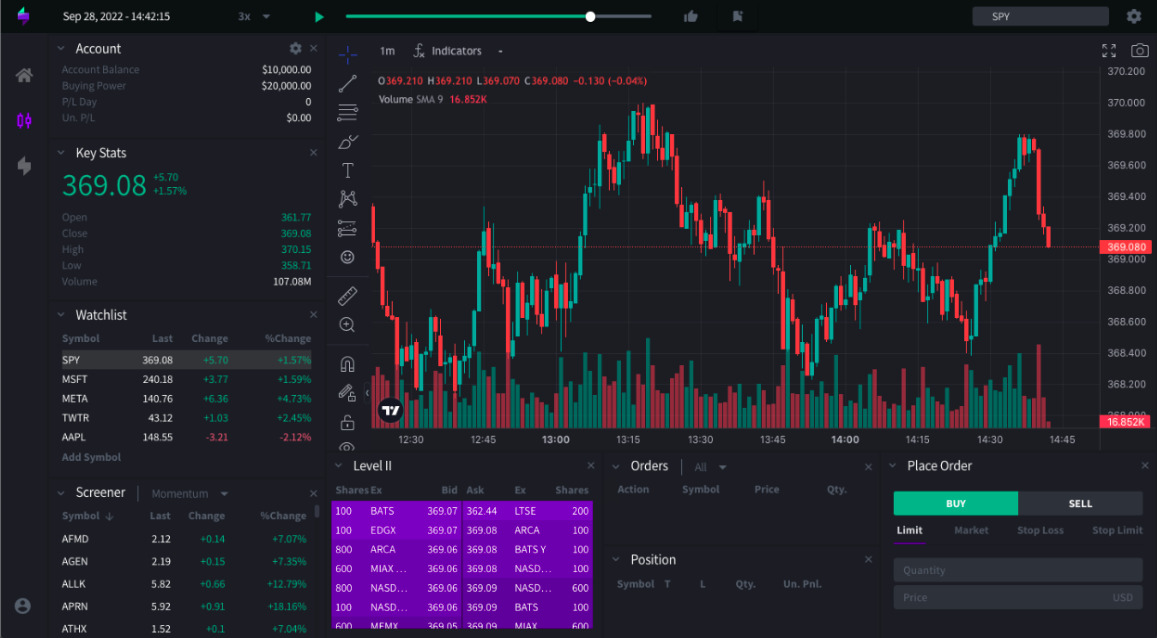

Users can meticulously analyze the outcomes of various trades, helping to bridge the gap between theoretical knowledge and practical application. One effective feature within trading simulators is the use of replay chart free tool. These tools enable traders to review historical data and market movements, simulating past trading scenarios to better understand market dynamics and test strategies under different conditions.

This capability allows traders to confront the emotional aspects of trading—often cited as a stumbling block for many—by experiencing the psychological pressures of decision-making without the fear of financial loss. Ultimately, trading simulators and replay chart tools empower individuals to build confidence and experience, setting the stage for more informed and measured approaches when they eventually transition to live trading.

Strategies to Maximize Learning from Simulators

To maximize learning from trading simulators, immerse yourself fully in the experience with a structured approach and a reflective mindset. Begin by setting specific, realistic goals for each session—are you aiming to master a particular strategy, or perhaps improve your risk management skills? Keep a trading journal, documenting your decisions and emotions during trades, allowing you to analyze your thought processes critically.

Incorporate variability by challenging yourself with different market conditions or instruments; this will simulate real-world unpredictability. Remember, simply executing trades is not enough.

Engage in post-analysis to dissect both your winning and losing trades—what worked, what didn’t, and why? Most importantly, treat the simulator as a learning tool rather than a gaming platform; adopt a disciplined attitude and cultivate habits that reflect those you would employ in actual trading scenarios. The key to genuine progress lies not just in repetition, but in thoughtful and deliberate practice.

Bridging the Gap Between Simulated and Real Trading

Bridging the gap between simulated and real trading requires more than just a seamless transition from a virtual platform to the live market; it demands a profound understanding of emotional resilience and decision-making under pressure. In the controlled environment of a simulator, traders can experiment with strategies and hone their skills without the immediate consequences of financial loss.

However, when faced with real stakes, the psychological landscape shifts dramatically. The thrill of a live trade can lead to irrational overconfidence or paralysis by analysis, turning even the most methodical trader into a bundle of nerves.

To effectively navigate this shift, its crucial to incorporate not just technical proficiency but also an acute awareness of one’s emotional responses. By regularly reflecting on their behaviors during simulations and seeking to replicate that mindset in real-time scenarios, traders can cultivate a balanced approach, one that marries analytical skills with the emotional intelligence necessary to thrive in the unpredictable dance of the markets.

Conclusion

In conclusion, while trading simulators can be an invaluable resource for aspiring traders to develop their skills and strategies, its crucial to approach them with a critical mindset to avoid the pitfalls of false confidence. By incorporating realistic scenarios, acknowledging emotional responses, and continuously reflecting on performance, traders can enhance their learning experience.

Utilizing tools like the replay chart free tool can further bridge the gap between simulation and real-market conditions, allowing traders to refine their decision-making and risk management under pressure. Ultimately, maintaining a grounded perspective and understanding the limitations of trading simulators will empower traders to navigate the markets with greater prudence and confidence.